A workplace pension a of saving your retirement that's arranged your employer. workplace pensions called 'occupational', 'works', 'company' 'work-based .

A pension a benefit some employers provide their employees. an employer offers pension, commit making contributions fund payments their employees retirement.

A pension a benefit some employers provide their employees. an employer offers pension, commit making contributions fund payments their employees retirement.

What a Pension? pension plan a favored kind retirement plan employees which employers commit paying defined benefit fixed amount money retirement. Pension plans a popular incentive retain employees of perks getting steady stream checks lasts length their retirement. However, traditional pension plans becoming .

What a Pension? pension plan a favored kind retirement plan employees which employers commit paying defined benefit fixed amount money retirement. Pension plans a popular incentive retain employees of perks getting steady stream checks lasts length their retirement. However, traditional pension plans becoming .

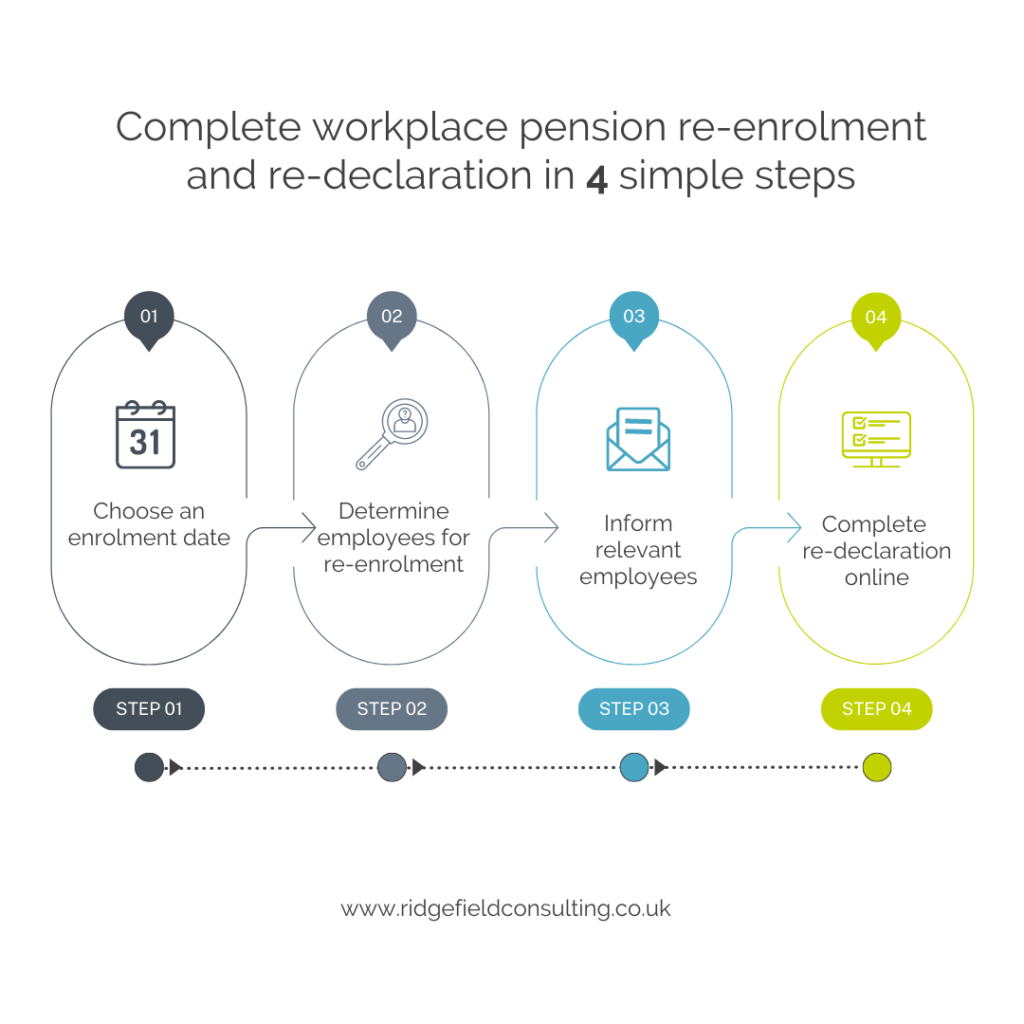

Workplace pensions set by employers help employees save their retirement. Read comprehensive guide & the facts workplace pensions.

Workplace pensions set by employers help employees save their retirement. Read comprehensive guide & the facts workplace pensions.

A workplace pension essentially savings scheme you, employer the government pay for later life.

A workplace pension essentially savings scheme you, employer the government pay for later life.

A workplace pension (occupational pension) a of saving your retirement that's arranged your employer. Discover about schemes.

A workplace pension (occupational pension) a of saving your retirement that's arranged your employer. Discover about schemes.

With and employer contributing it, workplace pension be best option saving retirement. what a workplace pension how they work?

With and employer contributing it, workplace pension be best option saving retirement. what a workplace pension how they work?

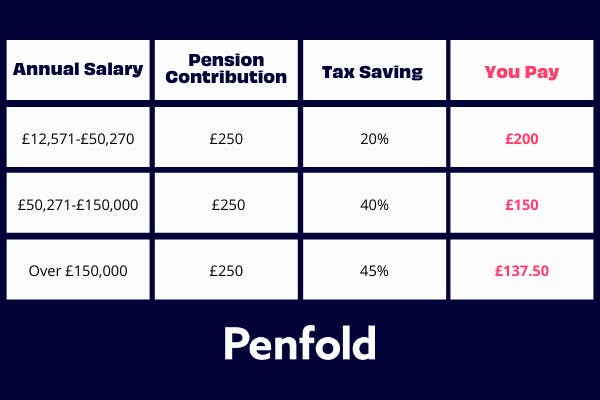

A workplace pension a pension that's arranged your employer. Contributions taken from wages paid your pension. Usually, employer adds money your pension, contributions the government be added the form tax relief.

A workplace pension a pension that's arranged your employer. Contributions taken from wages paid your pension. Usually, employer adds money your pension, contributions the government be added the form tax relief.

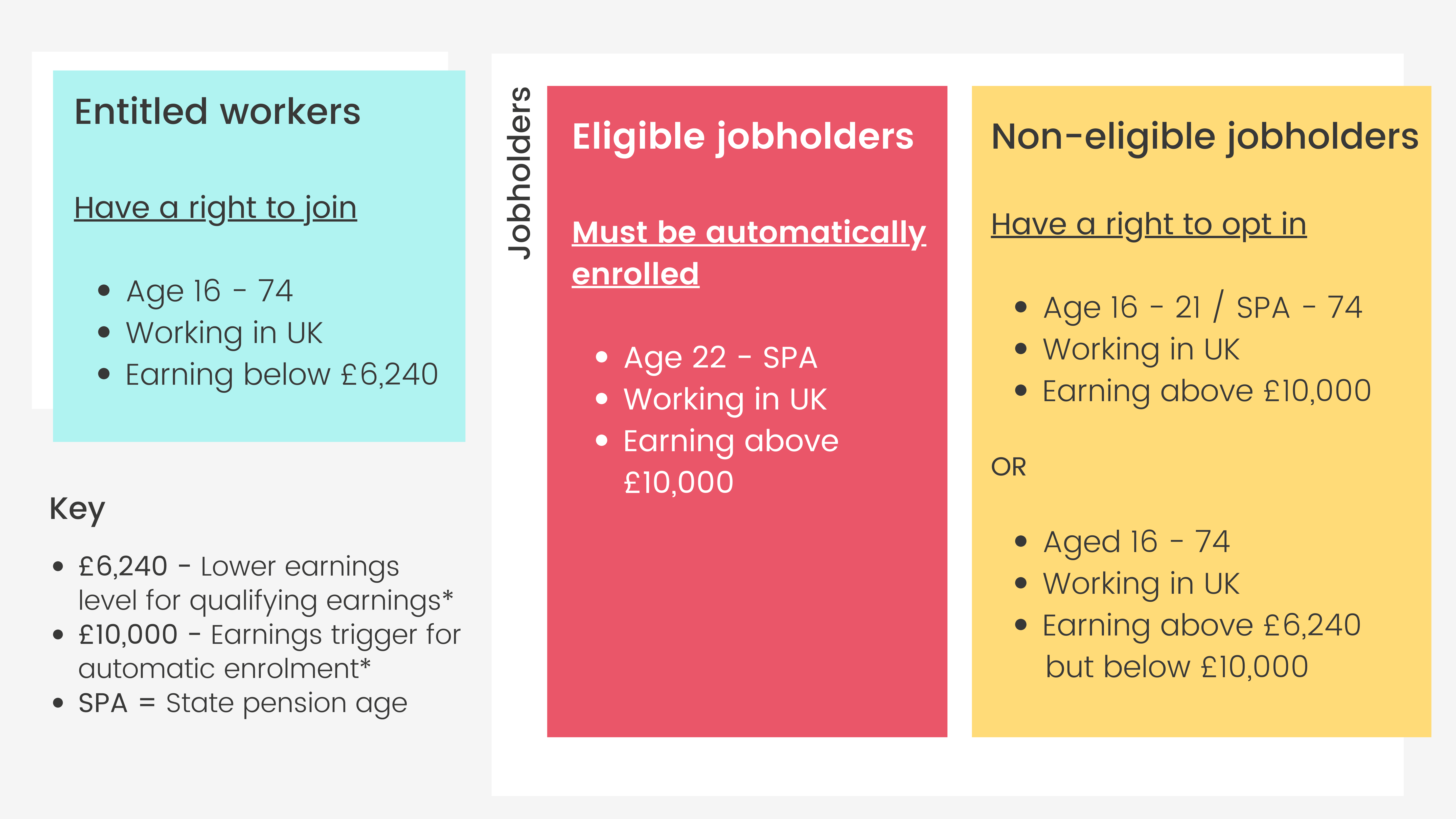

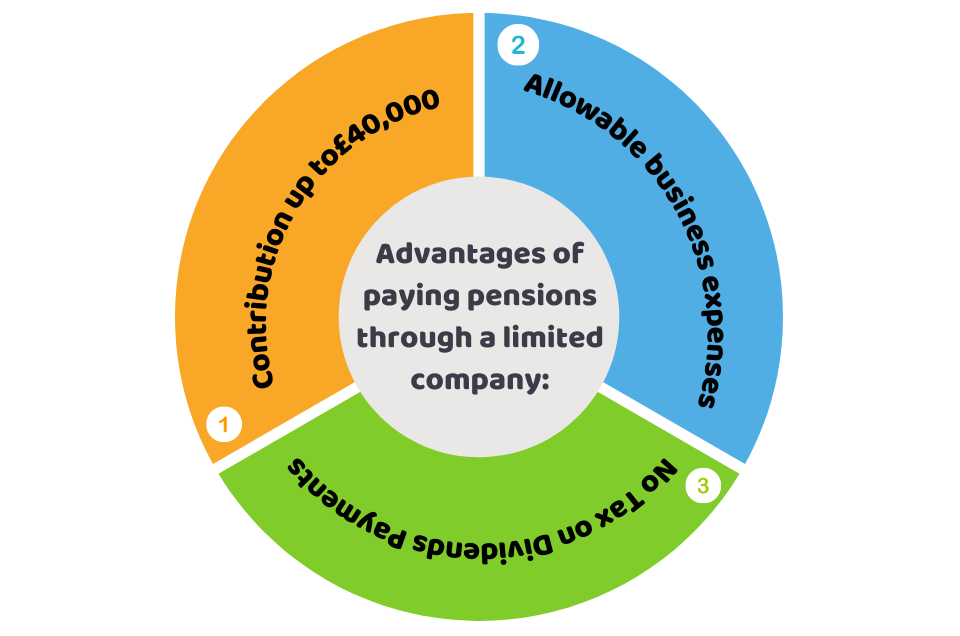

This comprehensive guide workplace pensions discusses different types workplace schemes, auto enrolment legislation, taxation benefits including salary sacrifice, options accessing pension. Click learn about workplace pensions.

This comprehensive guide workplace pensions discusses different types workplace schemes, auto enrolment legislation, taxation benefits including salary sacrifice, options accessing pension. Click learn about workplace pensions.

Workplace pension schemes run employers. time, contributions your workplace pension scheme up pension pot. contributions from (taken from wages) your employer.

Workplace pension schemes run employers. time, contributions your workplace pension scheme up pension pot. contributions from (taken from wages) your employer.

How UK workplace pensions work | Debitoor invoicing

How UK workplace pensions work | Debitoor invoicing